Creating Taxes

Taxes are configured individually on the Add Tax page and then combined into tax groups on the Tax

Groups page. Taxes must be configured according to the laws of your province/state/country.

Taxes have a regular and alternate rate. This allows two values to be assigned to the same tax. The regular or alternate rate can be selected for that tax in a tax group.

- On the Advanced Setup > Taxes > Taxes screen, click Add Tax.

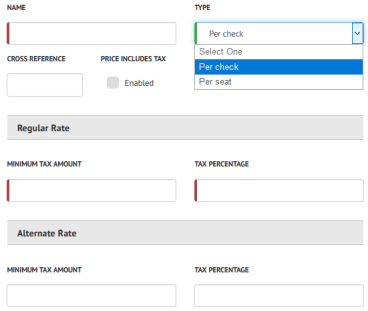

- The Add Tax page appears. In the Name field, enter a name for the tax.

- In the Type field, select either:

- Per Seat: Tax is calculated on the total amount of all the menu entries ordered on a seat.

- Per Check: The tax amount is calculated on the total amount of all the menu entries ordered on the check, which is the subtotal of the check.

NOTE: This field affects all taxes. Setting or changing this field will change the tax type for all taxes.

- (Optional) In the Cross Reference field, enter a cross-reference number for the tax.

- Price Includes Tax: This flag indicates whether prices are displayed on the menu before (disabled) or after (enabled) tax is calculated and applied (also known as "inclusive tax").

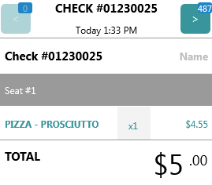

In the example below, the PIZZA - PROSCIUTTO menu entry is set a price of $5.00 in Menu Entry Setup, and set to a Tax

Group containing a 10% tax inclusive record (the Price Includes Tax flag is enabled).

|

The onscreen check area shows the subtotal of the item after the calculation to remove the tax amount, and the total value continues to reflect the total including tax. |

|

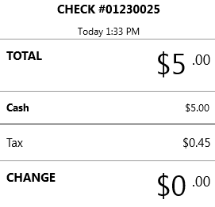

When paying for the check, the inclusive tax value is represented in the tax line. Note that in cases where a menu item is assigned to a tax group containing both inclusive and exclusive tax records, the tax values are combined on this line. They are separated on the check and receipt. |

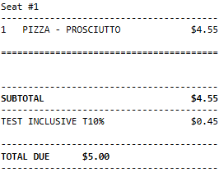

| On the check and receipt, the inclusive tax value is represented in the tax line. In cases where a menu item is assigned to a tax group containing both inclusive and exclusive tax records, the tax values are on separate lines. If the tax group contains both types of tax records, the inclusive taxes are calculated first and exclusive taxes are calculated from the adjusted gross price. |

- Minimum Tax Amount: Enter a dollar value that must be reached before the tax is applied to the check. Enter 0 if the tax should always apply.

- Tax Percentage: The percentage to charge for the tax (up to three decimal points, e.g. X.XXX).

Under the Alternate Rate header (Optional):

- Minimum Tax Amount: Enter a dollar value that must be reached before the tax is applied to the check. Enter 0 if the tax should always apply.

- Tax Percentage: The percentage to charge for the tax (up to three decimal points, e.g. X.XXX).

- Click Save Tax.

The tax is ready to be assigned to a tax group.